Energy Crisis & Central Bankers

Dan proposes doubling the cost of a gallon of gasoline. This is close to the experience of the 1973 oil shock, and Dan concedes that his proposal would pass through and cause a general price level increase (as it has done every single time there has been a supply shock). Central bankers don't like this because they have no good choices. Here's why.

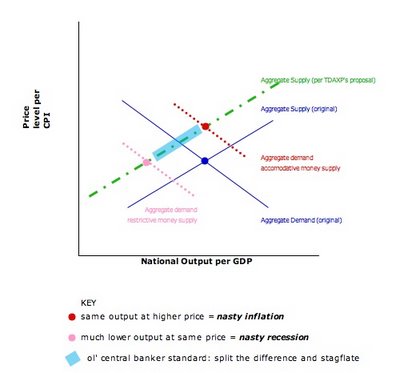

The dark blue thin lines are the original aggregate demand and supply curves (blue dot is today). The positive change in price levels is unknown, as Dan himself remains unclear on how much of an impact on CPI such a proposal would cause.

The dark blue thin lines are the original aggregate demand and supply curves (blue dot is today). The positive change in price levels is unknown, as Dan himself remains unclear on how much of an impact on CPI such a proposal would cause.

What is undisputed however is that every major supply shock in energy since the 1930s caused a jump in CPI (green line).

Central bankers then have three options. Either they can increase monetary supply which increases aggregate demand (red line), this though results in the same output at a higher price (red dot).

Or central bankers can decrease monetary supply which decreases aggregate demand (pink line), this though results in lower output at the same price (pink dot).

The third choice though is the one central bankers typically use, marginally less output for marginally more cost. This is stagflation (light blue zone).

The dark blue thin lines are the original aggregate demand and supply curves (blue dot is today). The positive change in price levels is unknown, as Dan himself remains unclear on how much of an impact on CPI such a proposal would cause.

The dark blue thin lines are the original aggregate demand and supply curves (blue dot is today). The positive change in price levels is unknown, as Dan himself remains unclear on how much of an impact on CPI such a proposal would cause. What is undisputed however is that every major supply shock in energy since the 1930s caused a jump in CPI (green line).

Central bankers then have three options. Either they can increase monetary supply which increases aggregate demand (red line), this though results in the same output at a higher price (red dot).

Or central bankers can decrease monetary supply which decreases aggregate demand (pink line), this though results in lower output at the same price (pink dot).

The third choice though is the one central bankers typically use, marginally less output for marginally more cost. This is stagflation (light blue zone).